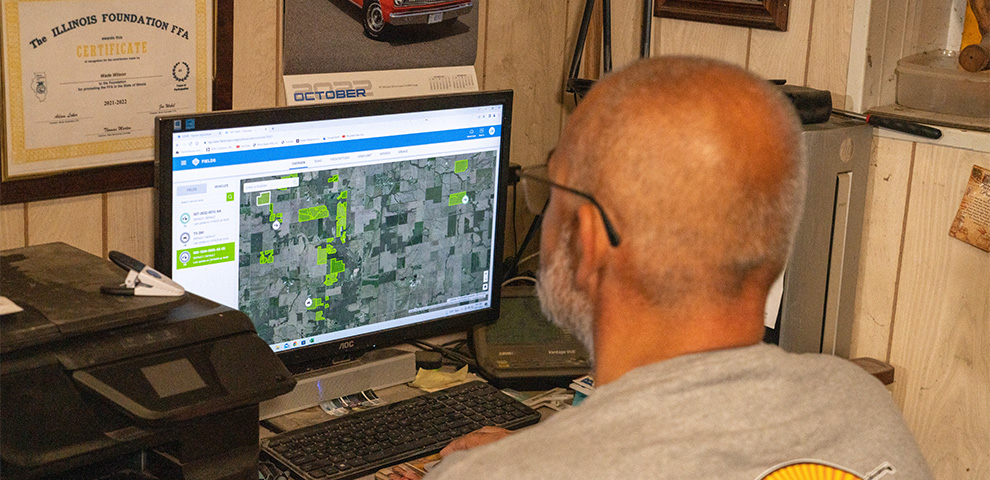

But recent updates to the USDA’s crop insurance requirements added electronic records of grain cart data as a viable source of harvest information for claims. The expansion, along with the 2022 collaboration between Topcon and MyAgData, is adding efficiency to the processing and payment of crop insurance claims.

“Crop insurance is an important tool that got me from 2019 to 2020, but I don’t buy it because I want to use it. I buy it so that if I must use it, I can make it to the next season,” Wilson says. “The ability now to electronically flow information straight to my loss adjuster for settling claims moves it to another level because my annual grain cart data is less than 1% error of what we’re actually delivering to the elevator.”

For Choteau, Mont., farmer Doug Weist, further automating the crop insurance process holds economic promise on his 4,000-acre small grains operation. He’s been collecting yield data for nearly a decade and added Smart Cart in 2000.

“We’re a single combine, single grain cart operation, so we’re pretty efficient. But my end goal is to close the digital loop on my farm data with crop insurance,” Weist says. “I am using MyAgData in conjunction with the TAP platform, and the objective with Smart Cart is to have it verify my yields at the end of the year because I’m already verifying my planted acres digitally.”

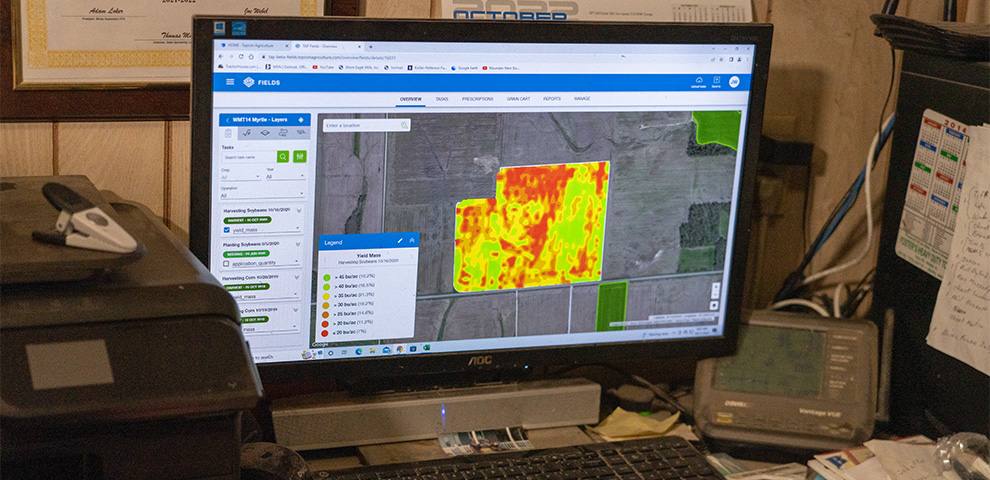

Typically, Weist validates his yield data by taking scale tickets from his grain cart and digitally verifies how many pounds came of each field when he creates harvest reports. The approach produces accurate data for crop insurance reporting, but Weist sees opportunity with electronic grain cart data to create an “easy button” that decreases turnaround time for payment of claims.

After submitting a claim for a crop failure in fall 2022, Weist compared the data he collected off his grain cart with the amount the adjuster calculated, and they were nearly identical.

“We measured all our bins, did all the calculations, and then I mentioned Smart Cart and our adjuster was blown away,” Weist says. “Instead of having to pull up, print and organize records for the agent, which is a big deal, even for a small farm like mine, I want to get to the point where whatever I report is accepted as accurate.

“If it triggers a payment, it triggers a payment. In my opinion, that would cut down on a lot of fraud, because the data is instant.”

If the data from Smart Cart gains traction with adjusters as a crop insurance reporting tool, Weist is optimistic that processing and payment of claims will take weeks instead of months.

“Ideally, as soon as we get done harvesting, there could be a check in my bank account within a week or two,” he says.